New Auto Legislation in Ontario

If you have been paying attention to the news recently, you may have heard that the FSCO (Financial Service Commission of Ontario) is making changes to auto insurance rates and coverage. These changes are part of a government-driven initiative to bring down premiums and make them more affordable to car owners. These changes will apply to all insurance policies issued or renewed after June 1, 2016

Why are they making these changes? In 2013, the government of Ontario promised to lower auto insurance premiums by 15%. This change is one of the ways that they are meeting that promise!

Why do I need to know? The FSCO’s changes will be reducing insurance rates, BUT they may also reduce the coverage on your insurance policy. If you want the same benefits as before, you may need to select additional coverage options.

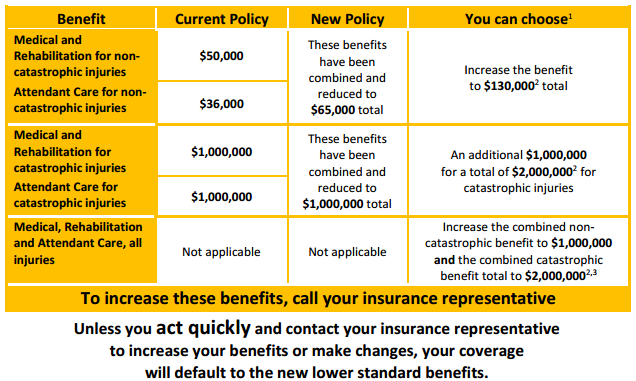

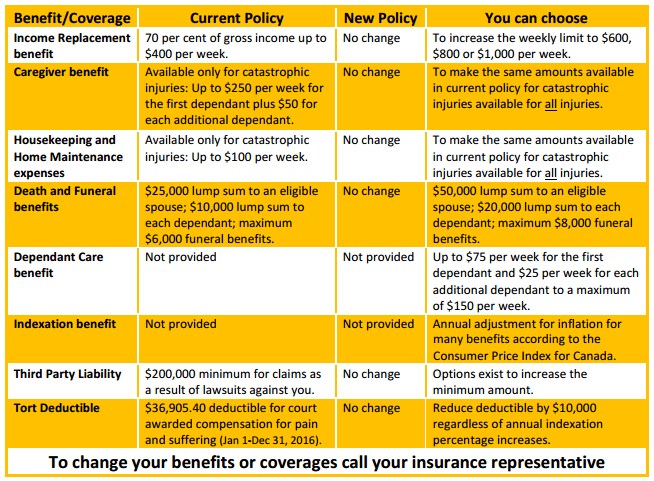

The most significant changes affect the Statutory Accident Benefits, which are available to you in all car accidents regardless of whether you are at-fault if you are injured. The coverage for these benefits has been reduced, so it is very important to look them over.

You can view the charts below for a comparison of current vs. new policies—or click this link to view the full letter from FSCO in PDF form:

Auto Insurance Changes in Ontario

When looking over the changes outlined by the FSCO, it is important to ask yourself a few of these key questions:

- Does your employer provide a group benefits plan? What is its limit? You should remember that OHIP will not cover all of your expenses for physiotherapy, mobility devices, prescriptions or other costs. Consider how you would cover medical expenses with the new, lowered coverage.

- Do you have any dependents, such as elderly parents or children? Who will care for them if you were injured in a car accident and unable to help? This is especially important for single parents.

- What are the costs of maintaining your current home? If you live in a house or condo, there may be standard costs associated with upkeep. But you should also consider who will take care of cleaning, if you were unable to do so. Could you pay for a housekeeper?

- How much are you and your family able to live on? Do you have alternate sources of income? The base amount of coverage for expenses is $400/week. Would that be enough or would you need to increase it?

- How much would your family need to pay for your funeral? No one likes to consider this possibility, but it is an important question to ask yourself.

What should I do? Contact your insurance broker at the Ostic Group to review your current coverage. They will be able to best advise you and help you navigate these new changes.

Looking for some extra information on the changes? Our team has broken down some of the other talking points below:

- Minor Accident Rules After June 1st: Companies can no longer use minor at-fault accidents to increase your premiums, if these accidents meet certain criteria:

- No payment by an insurer

- No injuries

- Damages less than $2,000 paid by at-fault driver

- Limited to one minor accident every 3 years

- Monthly Payment Plans: Maximum interest rate that can be charged has been reduced from 3% to 1.3% for one year policies.

- Comprehensive Deductible: Standard deductible for comprehensive coverage has been increased from $300 to $500.

- Non-Earner Benefit: The waiting period for people who are not working has been reduced from 6 months to 4 weeks. Benefits can only be received for up to 2 years after the accident.

- Duration of Medical, Rehabilitation and Attendant Care Benefits: Duration of this standard benefits is now 5 years for non-catastrophic injuries and will be paid as long as you remain medically eligible. Change does not apply to children.