Uber Driver Car Insurance in Ontario

The rapid rise of the ride-sharing economy is causing big changes to auto insurance in Canada. Many new Uber drivers are looking for car insurance and it is creating a shift in the industry.

At The Ostic Group, our team has continued to follow these changes with interest. As more and more people turn to ride-sharing apps like Uber and Lyft, using them as an alternative source of income, we have begun to explore options to support them in this space.

Since we wrote our last blog on the subject, more developments have taken place within the world of insurance. The Insurance Brokers Association of Ontario (IBAO) is actively encouraging all insurance providers in the province to provide coverage solutions for Uber drivers, Lyft drivers, and other rideshare drivers. Major insurance companies continue to refine their products for Uber drivers, in order to meet the growing needs of this new industry.

As a result, some great options are coming into the marketplace — and the team at The Ostic Group is here to help find the right one for you. What’s the bottom line? Watch the video below to find out:

If you are considering becoming an Uber drive, you need to contact your insurance broker to understand your level of exposure. Ensure that you are protected when using Uber, Lyft, or other ride-sharing apps — it’s that simple.

Uber Driver Insurance | Intact Insurance

Uber Rideshare Insurance is a new product created by the team at Intact Insurance and developed in collaboration with Uber directly. It applies to the Uber ridesharing program and their drivers exclusively (not to other ridesharing services).

This product is currently available for Uber drivers in Ontario and select other provinces across Canada. In this blog, we will focus on the features of the product available in Ontario.

What does the rideshare insurance coverage include?

This commercial coverage includes the following features and statutory accident benefits:

- Third party liability ($2 million): covers your liability to your riders (passengers) as a rideshare driver. This takes precedence over your personal auto coverage.

- Uninsured automobile coverage ($2 million: protects your passengers if they are injured in a hit-and-run. Also provides coverage for any accident with an uninsured or underinsured motorist.

- Property damage coverage: Pays for repairs to a driver’s vehicle and related expenses, if the driver was not wholly responsible for the accident.

- Contingent collision and comprehensive: For drivers who hold this same coverage on their personal auto insurance policy, this covers loss or physical damage to the rideshare driver’s vehicle with a $1,000 deductible (up to the current value of the vehicle).

When is the rideshare insurance policy in effect?

This policy extends from the moment when an Uber drivers makes themselves available to accept a ride request through the Uber app, until the moment their passengers exit the vehicle. In effect, it provides coverage between different Uber trips, while the driver is still on the job.

During this time period, the policy maintains $1 million in third party liability and uninsured automobile coverage (half of the regular coverage), along with the other coverages listed above.

What Uber ridesharing services does this policy cover?

This policy covers drivers in the below programs:

- UberX — Affordable, everyday rides for 1 to 4 people

- UberXL — Affordable SUVs for groups up to 6 (or a lot of luggage)

- UberSELECT — High-end rides at affordable prices for 1 to 4 people

- UberHOP — Commutes along popular routes during peak hours

- UberPOOL — Shared rides with shared costs (and shared savings)

This product does not cover drivers in UberEATS, the online food ordering and delivery branch of Uber. If you are looking for UberEATS insurance in Ontario, contact us for more information.

How does this fit with my personal auto policy?

Depending on your insurance provider, you may not need to make any changes to your personal auto policy to get proper coverage. You should talk to your broker for details.

For more info on Uber Rideshare Insurance, you can access the following resources:

The Challenges of Rideshare Insurance

The Challenges of Rideshare Insurance

Image Source: Intact Insurance

One of the biggest challenges facing both Uber drivers and insurers is the potential coverage gap between personal and commercial insurance policies. Uber drivers will frequently switch between a personal and commercial use of their vehicle, but it’s not always clear where one coverage ends and the other begins.

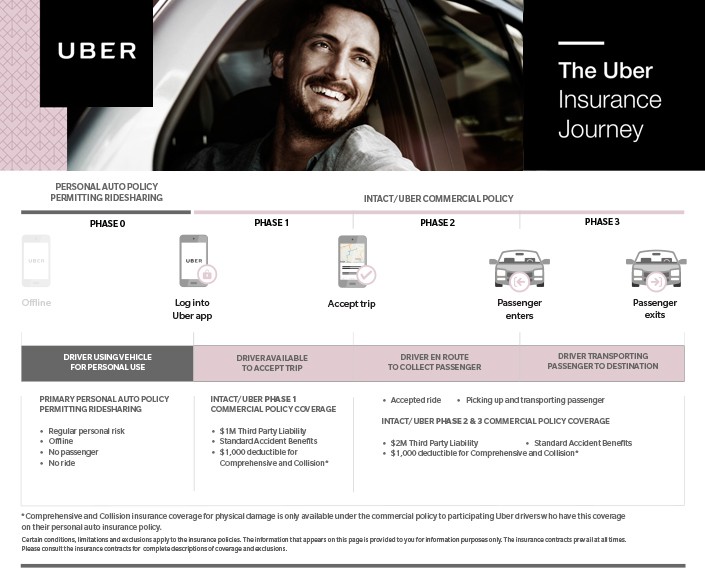

What’s been particularly contentious is what insurers call “Phase 1” — the time between when Uber drivers turned on their app and when the app connected with a passenger — an activity that has no analog with taxis or limos. Even Uber itself was hesitant, fearing coverage could be abused by turning the app on after getting into an accident. You can see an illustration of how Intact Insurance’s product addresses this challenge below:

Although the current policy provided by Intact addresses these problems, there may be future evolutions, as the product is refined. These technical nuances are part of why it’s so important to talk to a broker at The Ostic Group today to understand your exposure as an Uber driver.

Can you tell us more about this? I’d like to find out some additional information.

Hi there, if you’d like more information on Uber Driver insurance, we’d suggest calling our head office at (519) 843-2540. These type of policies will vary depending on your individual circumstances, so it would be easier to discuss your situation directly.

Hi.

Kindly help clarify these grey areas for me. If I have picked a delivery for an Uber Eats customer and I had an accident on the way to deliver the meal, my personal insurance is not aware that I drive for Uber but the accident was NOT my fault;

1. Will Uber contact my personal insurance while processing the claim?

2. If they do contact them, will I be penalized?

3. If I had already contacted my personal insurance, thinking they were to pursue the claim, how do I ask them to withdraw my claim?

4. Will Uber offer me the same settlement as my personal insurance would have?

Thank you

Very informative blog to have. Thanks

Good post. I certainly appreciate this website.

Thanks!